PMMY Loan

Get the Financial Support You Need with Ganpati Finance under PMMY Loan Scheme!

At Ganpati Finance, we believe in empowering individuals and small businesses to grow and succeed. To help you achieve your dreams, we are proud to offer financial support through the Pradhan Mantri Mudra Yojana (PMMY) – a government initiative designed to provide easy access to affordable loans.

What is PMMY?

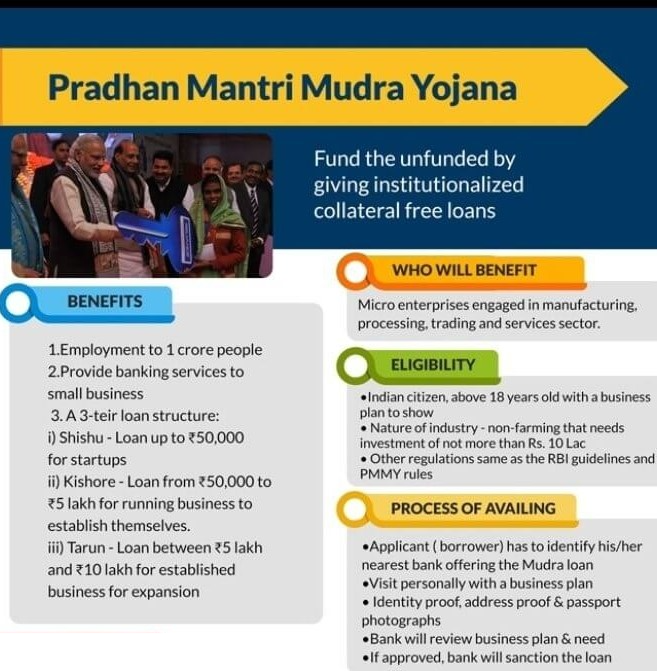

The Pradhan Mantri Mudra Yojana (PMMY) is a government scheme aimed at providing financial assistance to micro and small businesses across India. Whether you are a startup, a small business owner, or an entrepreneur, the PMMY loan helps you access the capital you need to scale your business and achieve financial independence. .

Why Choose Ganpati Finance for Your PMMY Loan?

Quick & Easy Process:

At Ganpati Finance, we ensure that your loan application process is hassle-free and simple. We help guide you through each step, making it easier for you to get the financial support you deserve.Low-Interest Rates:

We offer competitive interest rates that make it easier for you to repay your loan without stress.Flexible Loan Amounts:

Depending on your business needs, we provide loans ranging from ₹50,000 to ₹10 Lakhs, ensuring you get the right amount to fuel your growth.Minimal Documentation:

Our documentation process is quick, and we focus on getting you the financial help you need with minimal paperwork.

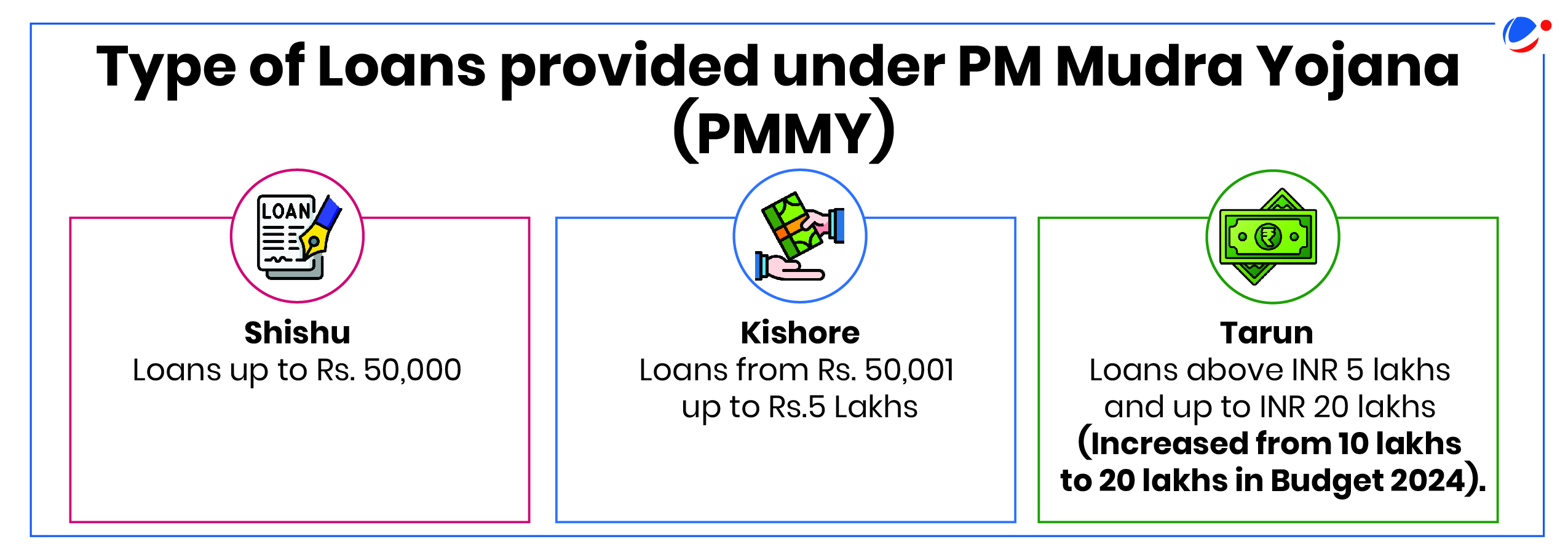

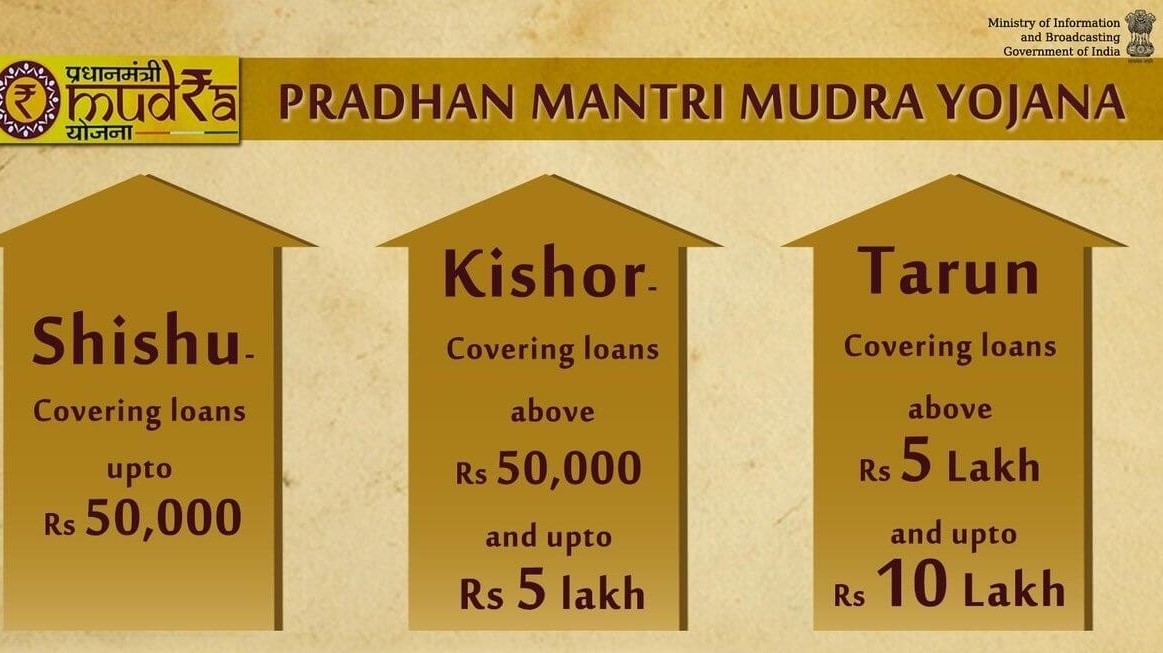

Types of Loans under PMMY Scheme

PMMY offers three types of loans depending on the size and nature of your business:

Shishu Loan:

For personal expenses, weddings, education, and more.Kishore Loan:

For purchasing, constructing, or renovating homes.Tarun Loan:

For expanding businesses, meeting working capital requirements, and more.

How Ganpati Finance Can Help You

Tailored Loan Solutions:

Whether you need funds for purchasing equipment, upgrading infrastructure, or managing working capital, Ganpati Finance provides personalized loan solutions to meet your unique requirements.Dedicated Support:

Our team is always ready to assist you in every step of the process, offering advice and ensuring you receive the best loan terms.

Eligibility Criteria

To avail of the PMMY loan through Ganpati Finance, you need to meet the following basic criteria:

- Indian citizen.

- A business or entrepreneurial activity requiring financial support.

- Age between 18 to 65 years.

- Minimal documentation, depending on the loan amount and type.

How to Apply?

Applying for a PMMY loan through Ganpati Finance is simple:

- Visit Our Office or Apply Online through our website.

- Provide basic details about your business.

- Submit the required documents.

- Our team will assist you in processing your loan application.

- Get approved and receive funds in your account quickly!

Why Wait? Apply for Your PMMY Loan Today!

At Ganpati Finance, we understand that financial support is key to your business’s success. That's why we are committed to offering you the best possible solutions under the PMMY loan scheme. Don’t let a lack of funds hold you back from growing your business – get started with Ganpati Finance today!

For more information or to apply, visit our website www.ganpatifinance.com or contact us at

Ganpati Finance – Empowering Your Financial Growth, One Step at a Time!