PMEGP Loan

Get the Financial Support You Need with Ganpati Finance under PMEGP Loan Scheme!

At Ganpati Finance, we believe in empowering individuals and small businesses to grow and succeed. To help you achieve your dreams, we are proud to offer financial support through the Prime Minister's Employment Generation Programme PMEGP – a government initiative designed to provide easy access to affordable loans.

What is PMEGP?

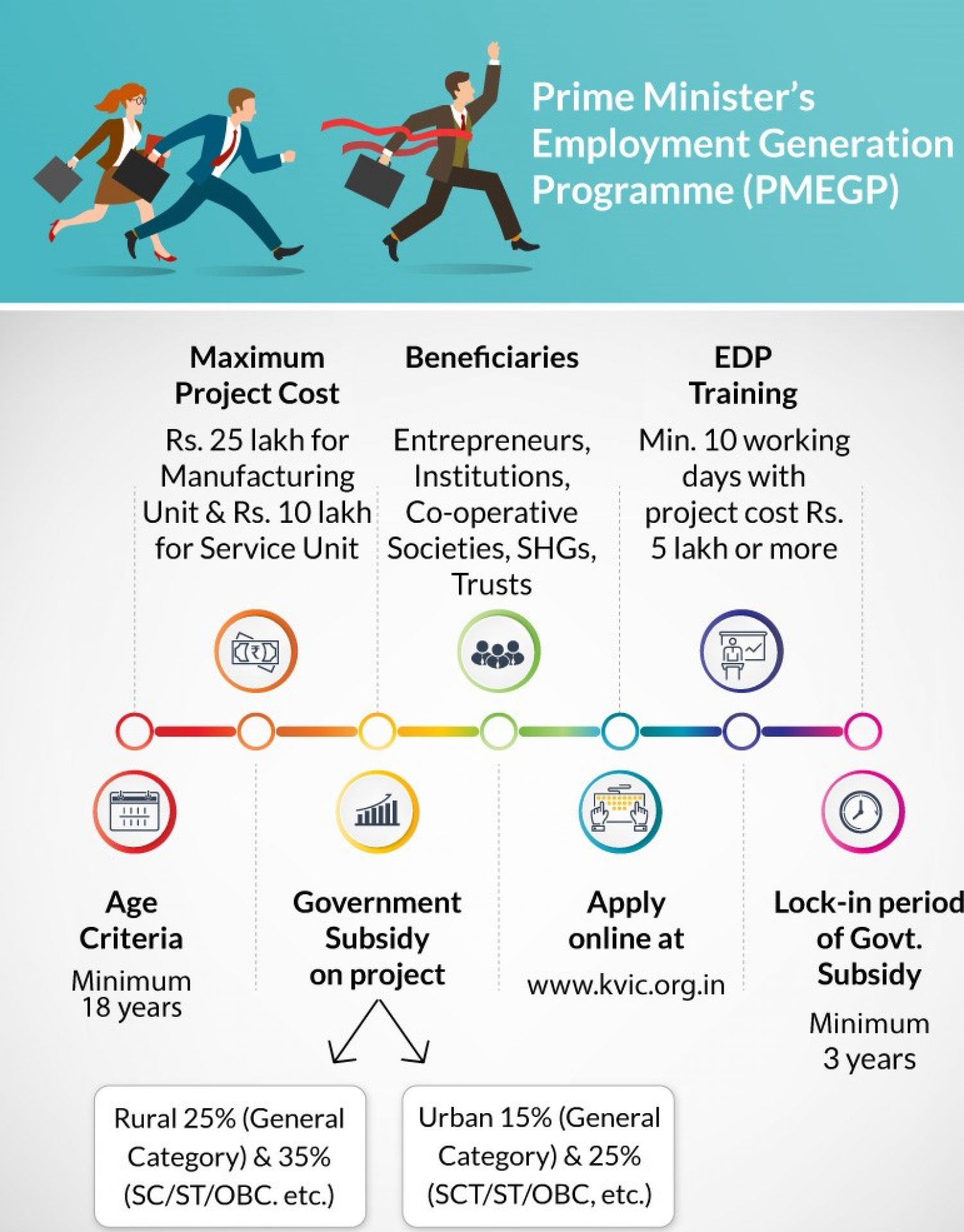

PMEGP stands for the Prime Minister's Employment Generation Programme. It is a government initiative designed to generate employment opportunities through the establishment of micro-enterprises in both rural and urban areas. The scheme provides financial assistance to individuals or groups to start new ventures in various sectors, contributing to job creation and economic growth.. .

How Ganpati Finance Helps You Get PMEGP Loans?

At Ganpati Finance, we help you navigate through the PMEGP loan process by offering expert assistance, guidance, and ensuring you get the best possible financial solution to start your business. Here's how we can assist:

Quick & Easy Process:

At Ganpati Finance, we ensure that your loan application process is hassle-free and simple. We help guide you through each step, making it easier for you to get the financial support you deserve.Low-Interest Rates:

We offer competitive interest rates that make it easier for you to repay your loan without stress.Bank Coordination & Loan Processing:

We coordinate with banks and financial institutions to process your loan application quickly.

Our team ensures timely follow-ups with the bank for approval.Government Subsidy Approval:

Once the loan is sanctioned, we help process your subsidy claim with KVIC & DIC.

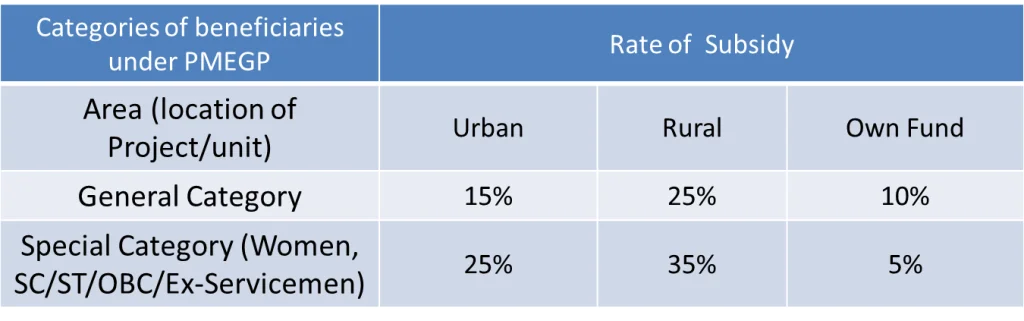

The government subsidy (15-35%) is credited to your loan account, reducing your financial burden.Post-Loan Support & Business Growth Guidance:

We provide ongoing business advice to help you utilize the funds effectively.

Assistance with GST registration, marketing, and financial management.Minimal Documentation:

Our documentation process is quick, and we focus on getting you the financial help you need with minimal paperwork.

Types of Loans under PMEGP loan

PMEGP offers three types of loans depending on the size and nature of your business:

Manufacturing Sector Loan:

Loan Amount: Up to ₹50 lakh.

Purpose: For businesses involved in production, manufacturing, fabrication, or processing of goods.Service Sector Loan:

Loan Amount: Up to ₹10 lakh.

Purpose: For businesses providing services or support activities.Trading & Business Loan:

Loan Amount: Up to ₹10 lakh.

Purpose: For businesses engaged in buying and selling goods.Agro-Based & Rural Industries Loan:

Loan Amount: Up to ₹50 lakh.

Purpose: For businesses based on agriculture and rural industries.Transport Sector Loan:

Loan Amount: Up to ₹10 lakh.

Purpose: For businesses in transportation and logistics.

How Ganpati Finance Can Help You

Tailored Loan Solutions:

Whether you need funds for purchasing equipment, upgrading infrastructure, or managing working capital, Ganpati Finance provides personalized loan solutions to meet your unique requirements.Dedicated Support:

Our team is always ready to assist you in every step of the process, offering advice and ensuring you receive the best loan terms.

Eligibility Criteria

To avail of the PMEGP loan through Ganpati Finance, you need to meet the following basic criteria:

- Must be 18 years or older.

- No income limit for applying.

- New enterprises only (existing businesses not eligible).

- At least 8th standard pass for projects above ₹10 lakh (manufacturing) or ₹5 lakh (services). Self-help groups (SHGs), cooperative societies, and trusts can also apply.

How to Apply?

Applying for a PMEGP loan through Ganpati Finance is simple:

- Visit Our Office or Apply Online through our website.

- Provide basic details about your business.

- Submit the required documents.

- Our team will assist you in processing your loan application.

- Get approved and receive funds in your account quickly!

Why Wait? Apply for Your PMEGP Loan Today!

At Ganpati Finance, we understand that financial support is key to your business’s success. That's why we are committed to offering you the best possible solutions under the PMEGP loan scheme. Don’t let a lack of funds hold you back from growing your business – get started with Ganpati Finance today!

For more information or to apply, visit our website www.ganpatifinance.com or contact us at

Ganpati Finance – Empowering Your Financial Growth, One Step at a Time!